In what prosecutors and lawmakers are calling one of the most brazen fraud scandals in recent U.S. memory, new court filings and government exhibits have peeled back the curtain on how hundreds of millions of dollars in stolen taxpayer funds were allegedly spent — not on the people they were meant to serve, but on luxury goods, exotic travel, real estate and, in some cases, overseas transfers that have prompted broader national security questions.

This investigation examines the origins of the fraud, how the money was misused, who is implicatedthe political fallout, and why the scandal has become a flashpoint in debates over government oversight, aid program integrity, and cultural tensions in Minnesota.

The Fraud Scheme at a Glance

At the center of the scandal is Feeding Our Future, a now‑defunct Minnesota nonprofit that claimed to distribute school meals under federal child nutrition programs. In reality, prosecutors say, the organization — and a network of associated shell corporations — submitted fraudulent claims for meals that were never provided to tens of thousands of children, siphoning off more than $240 million in taxpayer funding.

The group was not the only one involved — separate schemes allegedly defrauded Minnesota’s Housing Stabilization Services and , collectively involving dozens of defendants and hundreds of millions more in stolen funds.

Federal indictments and prosecutions have unfolded over the past several years, resulting in sentences, convictions, and ongoing litigation involving individuals ranging from nonprofit executives to business administrators.

Infuriating’ Spending Spree: How the Stolen Cash Was Used

Newly released court exhibits and investigative reporting reveal how a significant portion of the stolen money was allegedly spent:

Luxury Lifestyles Instead of Meals

Exotic Travel and Private Resorts: Evidence includes confirmation of luxury stays, such as overwater villas at premium resorts — in one case, in the Maldives — complete with video showing celebratory scenes far removed from nutrition distribution.

Luxury Vehicles: Prosecutors presented receipts for high‑end vehicles, including a 2021 Porsche Macan purchased with fraudulently obtained funds.

First‑Class International Flights: Dozens of first‑class tickets to destinations like Istanbul and Amsterdam appeared in documentation presented at trial.

Real Estate Investments: Properties were acquired both in Minnesota and abroad with proceeds from the fraud scheme.

Officials described these purchases as infuriating abuses of money intended for vulnerable children and families — a sentiment echoed by judges at sentencing hearings.

Key Prosecutions and Sentences

One of the more high‑profile convictions was ofAbdimajid Mohamed Nur, who pleaded guilty in 2025 to federal wire fraud and money‑laundering charges tied to the Feeding Our Future scheme. In October 2025, he was sentenced to 10 years in federal prison and ordered to pay nearly 48 million in restitution.

Nur’s case illustrated how sham nonprofits and shell companies were used to submit bogus reimbursement claims to the U.S. Department of Agriculture’s federal nutrition programs, inflating meal counts and masking the fact that few, if any, meals had been provided.

The Broader Scope: Multiple Schemes, Massive Losses

While Feeding Our Future has been the most widely covered element, federal prosecutors describe a network of related frauds:

Housing Stabilization Services: Another program meant to provide housing support was reportedly exploited, with stolen funds used to purchase luxury goods and invest in foreign real estate.

Medicaid and Autism Therapy Claims: Smaller schemes that billed Medicaid for services not rendered also appear to be part of the broader fraud landscape in Minnesota, drawing additional scrutiny from state authorities.

At least 77 individuals have been indicted, with dozens convicted and others still awaiting trial or sentencing.

Where Did the Money Go? Overseas Transfers and Security Concerns

Beyond luxury spending, the scandal has sparked lingering questions about where other stolen funds ended up. Recent developments in the broader investigation include:

Foreign Transfers Under Scrutiny: The U.S. Treasury announced enhanced tracking of transactions linked to the case, including money services businesses that may have been used to send fraudulent funds abroad — possibly to East Africa.

Terrorism Funding Fears: While federal officials have not publicly confirmed links between stolen funds and extremist groups, some reports and political commentators contend thatmoney may have been funneled to organizations like al‑Shabaab. Federal counterterrorism sources are said to be investigating these allegations.

Officials stress that no conclusive evidence has been publicly provided showing funds definitively reached terrorist organizations, even as investigations continue.

Political Fallout and Public Reaction

The scandal has reverberated beyond courtrooms into political arenas:

House Oversight Probe

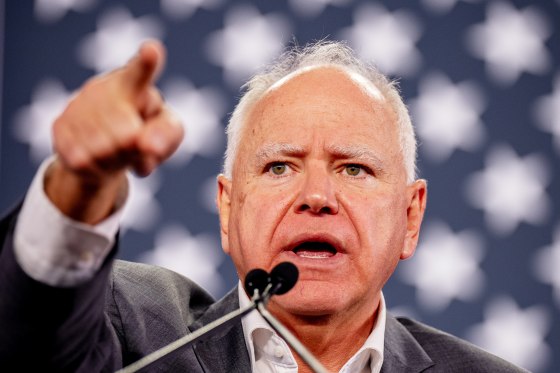

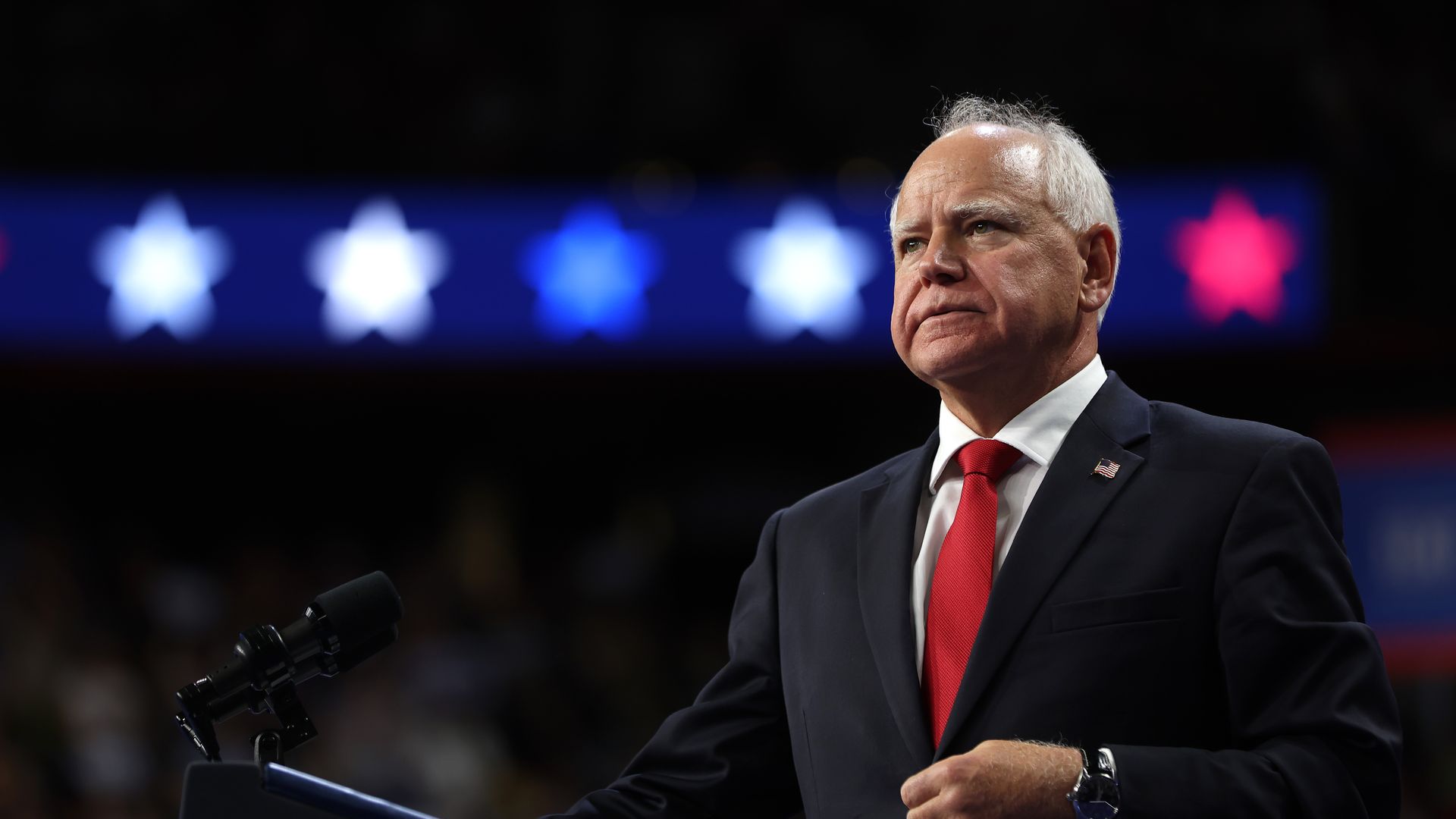

Republican lawmakers, led by House Oversight Committee Chairman James Comer, have launched a formal investigation into GovernorTim Walz’s handling of the fraud, alleging that state officials failed to act on early warnings and allowed the schemes to proliferate.

Tensions Over Community Associations

Minnesota’s Somali community has been at the center of media attention due to the involvement of some defendants of Somali descent. Representative Ilhan Omar, who represents a district with a large Somali population, has condemned both the fraud and xenophobic rhetoric tied to it, dismissing claims that community members broadly supported wrongdoing and rejecting accusations of terrorism funding.

Critics, however, argue that the scandals spotlight failures in government oversight and the misuse of public programs, fuelling heated debates on cultural, political, and administrative levels.

Challenges in Recovery and Oversight

Despite recoveries of some stolen funds and property, a large portion of the lost taxpayer money remains unrecovered. Prosecutors estimate that out of more than $250 million alleged to have been stolen by Feeding Our Future and related schemes, only a fraction has been recouped, as substantial amounts were already spent or transferred beyond the reach of U.S. authorities.

The case has prompted calls for tighter oversight of state and federal aid programs, improved auditing processes, and more robust mechanisms for detecting and preventing fraud — not only in Minnesota but nationwide.

The Human Cost

At the heart of the scandal lies a stark reality: taxpayer dollars intended to nourish and support children, families and vulnerable individuals were instead diverted for personal enrichment and questionable financial schemes. Parents, educators and community advocates have voiced frustration that meals weren’t delivered while fraud ran unchecked, describing the misuse as “infuriating” and a betrayal of public trust.

Advocates for program reform emphasize that while fraud must be prosecuted vigorously, most recipients of public assistance are law‑abiding and depend on these services legitimately. They warn against stigmatizing whole communities based on the actions of a subset of individuals. This nuance has become part of the broader public conversation around the scandal.

Looking Ahead

As trials continue and oversight efforts expand, Minnesota’s fraud scandal remains a developing story with implications for public policy, government accountability, and national debates over welfare integrity. Lawmakers and investigators are pushing for reforms, while federal agencies pursue complex financial leads — both domestic and international — tied to the misuse of taxpayer funds.

Conclusion

The newly disclosed details of how stolen cash from Minnesota’s massive fraud schemes was used paint a disturbing picture: a systematic exploitation of public funds meant to feed children and strengthen communities, diverted instead to luxury purchases, exotic travel, real estate investments and transnational money flows.

While convictions and probes are underway, the scandal highlights significant gaps in oversight, enforcement and program integrity. For taxpayers and communities alike, the fallout continues — as authorities strive not only to punish wrongdoing but to restore trust in the systems designed to protect the most vulnerable.